Reducing Energy Costs by Investing in Efficiency and Clean Renewable Energy Creates More Nationally-Distributed Jobs, Strengthens the Economy, and Protects the Climate

Washington, DC, 26 March 2021— A fresh look at the economics of job creation reveals that investment in energy efficiency, decarbonization, and clean renewable energy creates a larger and more sustainable number of jobs if you consider the construction and manufacturing jobs as well as the many jobs created when the energy bill savings are spent locally. The job and economic advantage is even higher when health care savings and improvements in productivity from clean air are taken into account, according to Investing in US Energy Efficiency and Infrastructure Creates More Nationally-Distributed Jobs while Saving Money and Protecting the Climate, a new analysis from Economic and Human Dimensions Research Associates (EHDRA) and the Institute for Governance & Sustainable Development (IGSD).

The Biden Administration’s strategy for recovery from the COVID-19 recession is to choose investments that can immediately deliver the nationally-distributed jobs that America needs while “building back better infrastructure” for long-term climate protection, prosperity, and social equity.

Simultaneously enhancing energy productivity and transitioning to clean renewable energy will require a substantial upgrade in existing and new infrastructure to enable greater economic productivity. Underpinning that transition is an array of information and communication technologies that will be necessary to support a highly productive electrification of the economy.

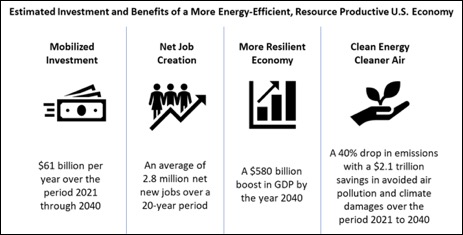

The new analysis calculates that mobilizing a cumulative investment of $1.2 trillion over the years 2021 through 2040 can reduce electricity end-use costs by about 40 percent by the year 2040*. This investment stimulates an average net employment benefit of 2.8 million new jobs per year even as the GDP increases more than $580 billion (in constant 2012 dollars) by the year 2040. The investment also would avoid on average $112 billion in air pollution and health costs (expressed in constant 2020 dollars). The cumulative benefit would be on the order of $2.1 trillion through 2040 (also in constant 2020 dollars), nearly twice the investment**.

An overall 40 percent decrease in total US energy expenditures—including all agricultural, industrial, building, and transportation energy uses—would generate an average of 8.7 million net new jobs per year through the year 2040. A 100 percent transformation of the US energy system away from fossil fuels and nuclear power plants to clean energy would result in an average of 20 million new net jobs per year by 2040.

Estimated Cost and Benefits of a Conservative 40% Reduction in Electricity Costs

The status quo where governments are still subsidizing fossil fuel is wasting everybody’s money. In contrast, investment in higher energy efficiency is quickly paid back with savings spent locally. The net job advantage occurs because fossil fuel is capital intensive, whereas spending on clean renewable energy and energy efficiency savings is labor-intensive, particularly when the new equipment is properly serviced for sustainable cost savings and energy and climate performance.

The report’s findings are based on the Dynamic Energy Efficiency Policy Evaluation Routine (DEEPER) analytic model with five critical components: 1) policy and program stimulus, 2) annual energy efficiency investments with concomitant energy bill savings and related benefits, 3) sector job coefficients and their anticipated labor productivity rates, 4) cost of borrowing to drive the desired change, and 5) a net employment estimator based on input-output analysis.

The analysis divides jobs into three categories: 1) direct on-site project jobs, 2) indirect off-site jobs to supply and deliver the materials and product to the on-site project, and 3) induced jobs when on-site and off-site wages and profits are spent in the communities of workers and investors. Clean energy is defined as geothermal, hydroelectric, solar, and wind that have low carbon footprint and insignificant pollution. The authors note that all of the sources considered clean require consideration of metrics beyond climate and pollution and must be properly designed, installed, and serviced. The study does not consider nuclear power because the cost of electricity from new plants is far higher than from clean competitive sources. Energy from biomass is also excluded because most deployment is not carbon-neutral in the near future, if ever when limiting warming to 1.5°C is critical to avoid crossing climate tipping points.

“The old thinking focused primarily on direct on-site project jobs,” said John “Skip” Laitner, Founder of Economic and Human Dimensions Research Associates and a co-author of the report. “This new thinking considers the economy-wide job impact INCLUDING the off-site jobs and particularly the induced jobs of wage and profit spending added to the induced jobs when electricity cost savings are spent locally.”

“Our analysis makes clear that savings from new lower-cost clean renewable energy and cost-effective energy efficiency investment will be spent locally and help create more induced jobs than direct and indirect jobs combined,” said Gabrielle Dreyfus, Senior Scientists at the Institute for Governance & Sustainable Development and co-author of the report. “Just as important, the induced jobs are sustained by continuous savings spent locally over the lifetime of the investment.”

The analysis’s comprehensive calculations allow policymakers to choose investments that can target disadvantaged members of the community with investment to lower their electricity cost so that more money is available for nutrition, health, education, and other spending for improved quality of life. Energy efficiency and solar, in particular, can be ubiquitously built or sited at individual homes and businesses or neighborhoods.

Out with fossil fuels and in with the new argument: the cheapest energy today and the most jobs come from renewables and energy efficiency. Here’s how it works:

“The surprisingly low cost of renewables” will drive utilities to close most of the remaining US coal plants over the next decade according to the 2019 Morgan Stanley research report, “The Second Wave of Clean Energy”;

Accelerate the transition to low-cost clean renewable energy by investing in electrification with transmission upgrades and streamlined permitting while halting tax shelters, federal leases, and other subsidies of fossil fuel;

Select investments to recover from the COVID-19 recession on the basis of the combined value of the investment (including climate protection) and the sum of direct, indirect, and induced jobs¬ accounting for savings on energy bills. Include in the analysis estimates of the geographic distribution of jobs and the number of new jobs at each wage level, mindful that some jobs have greater upward mobility than others.

The analysis, Investing in US Energy Efficiency and Infrastructure Creates More Nationally-Distributed Jobs while Saving Money and Protecting the Climate, with descriptions of the scenarios, methodology, data, and validation is here.

* A reduction in electricity costs can be achieved through energy efficiency, or by switching to a more productive means of electricity generation and distribution; for example, switching from fossil-fuel based to renewable forms of electricity generation and reducing losses that occur in the generation and transmission process. Thus a 40% reduction in electricity costs does not necessarily mean that consumers or businesses consume 40% less electricity at their homes or businesses. Rather, that 40% reduction in electricity costs could be achieved through a combination of factors, including more efficient and less wasteful production, generation, transmission, distribution, and consumption of energy.

** While the investment magnitudes were first provided in 2020 dollars, the economic projections in the reference case of the Annual Energy Outlook 2021, op cit., were provided in constant 2012 dollars. Hence, the reference to different base-year dollars provided in this supplemental analysis.